SHRTC Mock up

State Historic Rehabilitation Tax Credit Update: Applications are now being accepted!

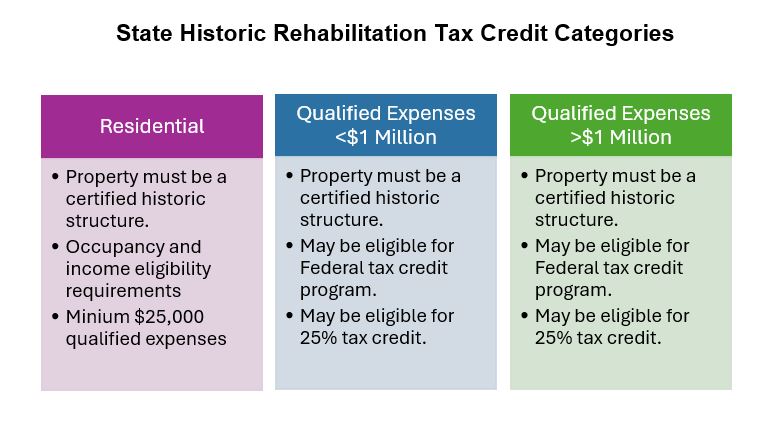

The state of California offers tax credits for the rehabilitation of eligible historic residential and income-producing properties. The State Historic Rehabilitation Tax Credit (SHRTC) program offers three tax credit categories. This page provides general information, outlining the program eligibility requirements and application process. Review program eligibility, program rules, frequently asked questions carefully. Program applications and instructions are below.

Program Overview

This section provides a general overview of the State Historic Rehabilitation Tax Credit (SHRTC) program. Additional information can be found in the FAQs section of this page or by referring to the Final Regulation Text.

State Historic Rehabilitation Tax Credit Program

Qualified rehabilitation projects may receive a tax credit of 20% of the qualified rehabilitation expenditures (QREs). Some projects may be eligible for a 25% tax credit (see Appendix D of the Regulation Text for eligibility criteria). Residential projects with a QRE greater than $125,000 are limited to a $25,000 tax credit allocation.

- Funds for the State Historic Rehabilitation Tax Credit have been allocated into three categories:

- A certified historic structure that is a qualified residence

- A certified historic building with qualified rehabilitation expenditures (QRE) of less than $1 million dollars

- A certified historic building with qualified rehabilitation expenditure (QRE) of $1 million dollars or more

- Applications will be reviewed until the allocated funds for that application category is depleted for the year.

- A completed Initial Project Application and application fees must be submitted to be considered.

Application and Project Eligibility

All projects must meet general eligibility requirements:

- Project property must be listed on the California Register of Historical Resources or National Register of Historic Places.

- Federal tax credit projects completed before January 1, 2022 are not eligible for the state rehabilitation tax credit.

- Projects with a qualified rehabilitation expenditures (QRE) costs below $25,000 do not qualify for a tax credit.

- The fee simple owner or someone with the written permission from the fee simple owner may apply.

Application Forms and Instructions

Below are links to the State Historic Rehabilitation Tax Credit application forms and instructions. These forms are available as fillable PDFs. Residential projects have the option to submit applications and supporting documents as hard copies.

Please make sure to read instructions thoroughly and fill out forms completely. Incomplete applications will be placed on hold until a completed application has been provided.

Application Instructions Link Here

Sections 1,2 and 3: Initial Project Application (v5/24) Link

Section 2: Application Narrative Template (v5/24) Link

Section 2: Amendment (v5/24) Link

Sections 4 and 5: Completed Project Application (v5/24) Link

Application Submittal

Submit Using OHP Document Portal

1. Prepare all application and supporting documentation files as directed in the instructions.

2. Email calshpo.tax@parks.ca.gov to request a link to a secure project folder. Provide the name and project part or amendment number of the application.

3. OHP staff creates the folder and returns the folder email link to the applicant as time allows, with a prompt to "open".

4. First-time users will be prompted by Microsoft to "SEND CODE" as verification of the email address. Click on the SEND CODE button.

5. An email is returned with the code. Enter the code in the field provided from the first email.

6. The folder opens. Use the menu at the top to upload documents.

OHP staff receive notification when documents are uploaded. Staff will time/date stamp each document and assign the application to a reviewer. All uploaded documents are processed in the order in which they are received.

The received time/date on the stamp reflects the time and date that staff process the application, not the delivery time and date of the upload.

Submit by Mail

Residential Project applications may be submitted by mail. Follow up correspondance from the OHP will be via email. Please note that the OHP will not mail back documents.

Application Fees

The Office of Historic Preservation charges a fee to review the Initial and the Completed Project applications. The fee amount depends on the project type and can be found in the Application Instructions. Fees must be submitted with the application for the application review to be performed. Fees are nonrefundable except if allocation funds are depleted.

Frequently Asked Questions

What is a Qualified Residence?

To be eligible for the tax credit, the residence must be owned and occupied by an individual taxpayer who has a modified adjusted gross income of $200,000 or less, and the project property must be the taxpayer’s principal residence or what will be the taxpayer’s principal residence within two years after the rehabilitation of the residence.

In addition, the residence must be a Certified Historic Structure, be listed on the California Register of Historical Resources or listed as a contributor to a registered historic district that is listed in the California Register. .

What is a Certified Historic Structure/Building?

To be eligible for the tax credit, the property must be individually listed in the California Register of Historical Resource or listed as a contributor to a registered historic district that is listed in the California Register.

What does Rehabilitation mean?

In the context of this program, "rehabilitation" is defined in §4859.02 Definition of Key Terms: "the process of returning a building or buildings to a state of utility, through repair or alteration, which makes possible an efficient use while preserving those portions and features of the building and its site and environment that are significant to its historic, architectural, and cultural values as determined by the Office of Historic Preservation."

What is a Qualified Rehabilitation Expenditure?

Qualified rehabilitation expenditures may include expenditures in connection with the rehabilitation of a building or rehabilitation expenditures incurred by the taxpayer with respect to a qualified residence for the rehabilitation of the exterior of the building or rehabilitation necessary for the functioning of the home, including, but not limited to, rehabilitation of the electrical, plumbing, or foundation of the qualified residence.

How do I know if my property is on the California Register?

Try searching the databases linked below:

Built Environment Resources Directory (BERD) Use the accompanying Status Codes to determine the status of the property

California Historical Resources

National Register of Historic Places

If you think your property is listed on the California Register but cannot locate the listing, after searching the above resources, please contact us at calshpo.tax@parks.ca.gov, using subject line “CR listing status request for <property address, city and county>.” In the body of the email, provide the full name of the correspondent, the historic name the building is known by (if any), and the year the building was built, if known. Photos of the property may be attached at the correspondent’s option.

How do I get my property listed on the California Register or National Register?

Nomination and listing of a property in the California or National Register is a separate regulatory action which must be completed before applying for state tax credit. Please visit the "Procedures for Registration" section of the California Register of Historical Resources page.

The length of the nomination process varies and depends on the completeness of the nomination packet, how responsive the nominee is to requests for additional information, the timing of the application submittal and the volume of nominations received. In general, eligible property nominations take 6-12 months to be added to the California Register.

It is highly recommended that nominees thoroughly read the California Register Checklist for Submission and closely follow instructions.

Can past recipients of the Federal Historic Tax Credit program apply for the State Historic Rehabilitation Tax Credit?

Federal tax credit projects completed or participating in the federal review process on or after January 1, 2022, can apply for the state program. They must submit an Initial Project application with fees to receive approval from OHP and tax allocation from the CTCAC. Completed projects must submit a Completed Project Application with application and processing fees. Since funding for the SHRTC was not available before January 1, 2022, federal projects completed before that time are not elidgible to recieve funds.

Can I apply for both the state and federal rehabilitation tax programs?

Projects may be eligible for both the federal and state tax credit programs. The federal tax credit program requires that after rehabilitation, the historic building must be depreciable, such as in a business, commercial or other income-producing use, for at least five years. Owner-occupied residential properties do not qualify for the federal rehabilitation tax credit program.

Projects applying for the federal program must also submit required application forms from the National Parks Service.

What happens when the funds run out?

As each tax credit funding category is exhausted, the OHP will stop taking applications for that category. The OHP will return any unprocessed applications and fees to the applicant.

Project Status